目录

学习目标

内容介绍

代码示例

导入数据分析及可视化过程需要的库

读取文件

总体了解

查看数据集中特征缺失值,唯一值等

查看特征的数值类型有哪些,对象类型有哪些

变量分布可视化

时间格式数据处理及查看

掌握透视图可以让我们更好的了解数据

用pandas_profiling生成数据报告

总结

学习目标

- 学习如何对数据集整体概况进行分析,包括数据集的基本情况(缺失值,异常值)

- 学习了解变量间的相互关系、变量与预测值之间的存在关系

内容介绍

- 数据总体了解:

- 读取数据集并了解数据集大小,原始特征维度;

- 通过info熟悉数据类型;

- 粗略查看数据集中各特征基本统计量;

- 缺失值和唯一值:

- 查看数据缺失值情况

- 查看唯一值特征情况

- 深入数据-查看数据类型

- 类别型数据

- 数值型数据

- 离散数值型数据

- 连续数值型数据

- 数据间相关关系

- 特征和特征之间关系

- 特征和目标变量之间关系

- 用pandas_profiling生成数据报告

代码示例

导入数据分析及可视化过程需要的库

import pandas as pd

import numpy as np

import matplotlib.pyplot as plt

import seaborn as sns

import datetime

import warnings

warnings.filterwarnings('ignore')读取文件

data_train = pd.read_csv('./train.csv')

data_test_a = pd.read_csv('./testA.csv')- pandas读取数据时相对路径载入报错时,尝试使用os.getcwd()查看当前工作目录;

- TSV与CSV的区别:

- 从名称上即可知道,TSV是用制表符(Tab,'t')作为字段值的分隔符;CSV是用半角逗号(',')作为字段值的分隔符;

- Python对TSV文件的支持: Python的csv模块准确的讲应该叫做dsv模块,因为它实际上是支持范式的分隔符分隔值文件(DSV,delimiter-separated values)的。 delimiter参数值默认为半角逗号,即默认将被处理文件视为CSV。当delimiter='t'时,被处理文件就是TSV;

- 读取文件的部分(适用于文件特别大的场景)

- 通过nrows参数,来设置读取文件的前多少行,nrows是一个大于等于0的整数;

- 分块读取;

data_train_sample = pd.read_csv("./train.csv", nrows=5) # 只读取5行数据#设置chunksize参数,来控制每次迭代数据的大小

chunker = pd.read_csv("./train.csv", chunksize=5)

for item in chunker:

print(type(item))

#<class 'pandas.core.frame.DataFrame'>

print(len(item))

#5总体了解

- 查看数据集的样本个数和原始特征维度;

- 训练数据共80万条,测试数据共20万条;

data_train.shape

# (800000, 47)data_test_a.shape

# (200000, 48)- 测试集与训练集相比,少了isDefault特征,多了两个特征n2.2和n2.3;

data_train.columns| Field | Description |

|---|---|

| id | 为贷款清单分配的唯一信用证标识 |

| loanAmnt | 贷款金额 |

| term | 贷款期限(year) |

| interestRate | 贷款利率 |

| installment | 分期付款金额 |

| grade | 贷款等级 |

| subGrade | 贷款等级之子级 |

| employmentTitle | 就业职称 |

| employmentLength | 就业年限(年) |

| homeOwnership | 借款人在登记时提供的房屋所有权状况 |

| annualIncome | 年收入 |

| verificationStatus | 验证状态 |

| issueDate | 贷款发放的月份 |

| purpose | 借款人在贷款申请时的贷款用途类别 |

| postCode | 借款人在贷款申请中提供的邮政编码的前3位数字 |

| regionCode | 地区编码 |

| dti | 债务收入比 |

| delinquency_2years | 借款人过去2年信用档案中逾期30天以上的违约事件数 |

| ficoRangeLow | 借款人在贷款发放时的fico所属的下限范围 |

| ficoRangeHigh | 借款人在贷款发放时的fico所属的上限范围 |

| openAcc | 借款人信用档案中未结信用额度的数量 |

| pubRec | 贬损公共记录的数量 |

| pubRecBankruptcies | 公开记录清除的数量 |

| revolBal | 信贷周转余额合计 |

| revolUtil | 循环额度利用率,或借款人使用的相对于所有可用循环信贷的信贷金额 |

| totalAcc | 借款人信用档案中当前的信用额度总数 |

| initialListStatus | 贷款的初始列表状态 |

| applicationType | 表明贷款是个人申请还是与两个共同借款人的联合申请 |

| earliesCreditLine | 借款人最早报告的信用额度开立的月份 |

| title | 借款人提供的贷款名称 |

| policyCode | 公开可用的策略_代码=1新产品不公开可用的策略_代码=2 |

| n系列匿名特征 | 匿名特征n0-n14,为一些贷款人行为计数特征的处理 |

- 通过info()来熟悉数据类型;

data_train.info()

# <class 'pandas.core.frame.DataFrame'>

# RangeIndex: 800000 entries, 0 to 799999

# Data columns (total 47 columns):

# # Column Non-Null Count Dtype

# --- ------ -------------- -----

# 0 id 800000 non-null int64

# 1 loanAmnt 800000 non-null float64

# 2 term 800000 non-null int64

# 3 interestRate 800000 non-null float64

# 4 installment 800000 non-null float64

# 5 grade 800000 non-null object

# 6 subGrade 800000 non-null object

# 7 employmentTitle 799999 non-null float64

# 8 employmentLength 753201 non-null object

# 9 homeOwnership 800000 non-null int64

# 10 annualIncome 800000 non-null float64

# 11 verificationStatus 800000 non-null int64

# 12 issueDate 800000 non-null object

# 13 isDefault 800000 non-null int64

# 14 purpose 800000 non-null int64

# 15 postCode 799999 non-null float64

# 16 regionCode 800000 non-null int64

# 17 dti 799761 non-null float64

# 18 delinquency_2years 800000 non-null float64

# 19 ficoRangeLow 800000 non-null float64

# 20 ficoRangeHigh 800000 non-null float64

# 21 openAcc 800000 non-null float64

# 22 pubRec 800000 non-null float64

# 23 pubRecBankruptcies 799595 non-null float64

# 24 revolBal 800000 non-null float64

# 25 revolUtil 799469 non-null float64

# 26 totalAcc 800000 non-null float64

# 27 initialListStatus 800000 non-null int64

# 28 applicationType 800000 non-null int64

# 29 earliesCreditLine 800000 non-null object

# 30 title 799999 non-null float64

# 31 policyCode 800000 non-null float64

# 32 n0 759730 non-null float64

# 33 n1 759730 non-null float64

# 34 n2 759730 non-null float64

# 35 n2.1 759730 non-null float64

# 36 n4 766761 non-null float64

# 37 n5 759730 non-null float64

# 38 n6 759730 non-null float64

# 39 n7 759730 non-null float64

# 40 n8 759729 non-null float64

# 41 n9 759730 non-null float64

# 42 n10 766761 non-null float64

# 43 n11 730248 non-null float64

# 44 n12 759730 non-null float64

# 45 n13 759730 non-null float64

# 46 n14 759730 non-null float64

# dtypes: float64(33), int64(9), object(5)

# memory usage: 286.9+ MB- 总体粗略的查看数据集各个特征的一些基本统计量;

- 其中,object类型的特征无法进行统计计算;

data_train.describe()| id | loanAmnt | term | interestRate | installment | employmentTitle | homeOwnership | annualIncome | verificationStatus | isDefault | ... | n5 | n6 | n7 | n8 | n9 | n10 | n11 | n12 | n13 | n14 | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| count | 800000.000000 | 800000.000000 | 800000.000000 | 800000.000000 | 800000.000000 | 799999.000000 | 800000.000000 | 8.000000e+05 | 800000.000000 | 800000.000000 | ... | 759730.000000 | 759730.000000 | 759730.000000 | 759729.000000 | 759730.000000 | 766761.000000 | 730248.000000 | 759730.000000 | 759730.000000 | 759730.000000 |

| mean | 399999.500000 | 14416.818875 | 3.482745 | 13.238391 | 437.947723 | 72005.351714 | 0.614213 | 7.613391e+04 | 1.009683 | 0.199513 | ... | 8.107937 | 8.575994 | 8.282953 | 14.622488 | 5.592345 | 11.643896 | 0.000815 | 0.003384 | 0.089366 | 2.178606 |

| std | 230940.252013 | 8716.086178 | 0.855832 | 4.765757 | 261.460393 | 106585.640204 | 0.675749 | 6.894751e+04 | 0.782716 | 0.399634 | ... | 4.799210 | 7.400536 | 4.561689 | 8.124610 | 3.216184 | 5.484104 | 0.030075 | 0.062041 | 0.509069 | 1.844377 |

| min | 0.000000 | 500.000000 | 3.000000 | 5.310000 | 15.690000 | 0.000000 | 0.000000 | 0.000000e+00 | 0.000000 | 0.000000 | ... | 0.000000 | 0.000000 | 0.000000 | 1.000000 | 0.000000 | 0.000000 | 0.000000 | 0.000000 | 0.000000 | 0.000000 |

| 25% | 199999.750000 | 8000.000000 | 3.000000 | 9.750000 | 248.450000 | 427.000000 | 0.000000 | 4.560000e+04 | 0.000000 | 0.000000 | ... | 5.000000 | 4.000000 | 5.000000 | 9.000000 | 3.000000 | 8.000000 | 0.000000 | 0.000000 | 0.000000 | 1.000000 |

| 50% | 399999.500000 | 12000.000000 | 3.000000 | 12.740000 | 375.135000 | 7755.000000 | 1.000000 | 6.500000e+04 | 1.000000 | 0.000000 | ... | 7.000000 | 7.000000 | 7.000000 | 13.000000 | 5.000000 | 11.000000 | 0.000000 | 0.000000 | 0.000000 | 2.000000 |

| 75% | 599999.250000 | 20000.000000 | 3.000000 | 15.990000 | 580.710000 | 117663.500000 | 1.000000 | 9.000000e+04 | 2.000000 | 0.000000 | ... | 11.000000 | 11.000000 | 10.000000 | 19.000000 | 7.000000 | 14.000000 | 0.000000 | 0.000000 | 0.000000 | 3.000000 |

| max | 799999.000000 | 40000.000000 | 5.000000 | 30.990000 | 1715.420000 | 378351.000000 | 5.000000 | 1.099920e+07 | 2.000000 | 1.000000 | ... | 70.000000 | 132.000000 | 79.000000 | 128.000000 | 45.000000 | 82.000000 | 4.000000 | 4.000000 | 39.000000 | 30.000000 |

8 rows × 42 columns

- 查看头尾各3条数据;

data_train.head(3).append(data_train.tail(3))| id | loanAmnt | term | interestRate | installment | grade | subGrade | employmentTitle | employmentLength | homeOwnership | ... | n5 | n6 | n7 | n8 | n9 | n10 | n11 | n12 | n13 | n14 | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 0 | 0 | 35000.0 | 5 | 19.52 | 917.97 | E | E2 | 320.0 | 2 years | 2 | ... | 9.0 | 8.0 | 4.0 | 12.0 | 2.0 | 7.0 | 0.0 | 0.0 | 0.0 | 2.0 |

| 1 | 1 | 18000.0 | 5 | 18.49 | 461.90 | D | D2 | 219843.0 | 5 years | 0 | ... | NaN | NaN | NaN | NaN | NaN | 13.0 | NaN | NaN | NaN | NaN |

| 2 | 2 | 12000.0 | 5 | 16.99 | 298.17 | D | D3 | 31698.0 | 8 years | 0 | ... | 0.0 | 21.0 | 4.0 | 5.0 | 3.0 | 11.0 | 0.0 | 0.0 | 0.0 | 4.0 |

| 799997 | 799997 | 6000.0 | 3 | 13.33 | 203.12 | C | C3 | 2582.0 | 10+ years | 1 | ... | 4.0 | 26.0 | 4.0 | 10.0 | 4.0 | 5.0 | 0.0 | 0.0 | 1.0 | 4.0 |

| 799998 | 799998 | 19200.0 | 3 | 6.92 | 592.14 | A | A4 | 151.0 | 10+ years | 0 | ... | 10.0 | 6.0 | 12.0 | 22.0 | 8.0 | 16.0 | 0.0 | 0.0 | 0.0 | 5.0 |

| 799999 | 799999 | 9000.0 | 3 | 11.06 | 294.91 | B | B3 | 13.0 | 5 years | 0 | ... | 3.0 | 4.0 | 4.0 | 8.0 | 3.0 | 7.0 | 0.0 | 0.0 | 0.0 | 2.0 |

6 rows × 47 columns

查看数据集中特征缺失值,唯一值等

- 查看缺失值;

print(f'There are {data_train.isnull().any().sum()} columns in train dataset with missing values.')

# There are 22 columns in train dataset with missing values.- 上面得到训练集有22列特征有缺失值,进一步查看缺失特征中缺失率大于50%的特征,结果:没有缺失率大于50%的特征;

have_null_fea_dict = (data_train.isnull().sum() / len(data_train)).to_dict()

fea_null_moreThanHalf = {}

for key, value in have_null_fea_dict.items():

if value > 0.5:

fea_null_moreThanHalf[key] = value

fea_null_moreThanHalf

# {}- 查看缺失特征及缺失率;

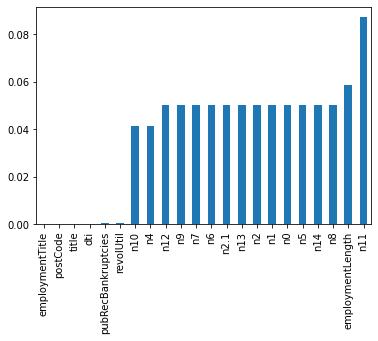

- n11有最高的缺失率9%,有缺失数据的特征共22个;

# nan可视化

missing = data_train.isnull().sum() / len(data_train)

missing = missing[missing > 0]

missing.sort_values(inplace=True)

missing.plot.bar()

- 纵向了解哪些列存在 “nan”, 并可以把nan的个数打印,主要的目的在于查看某一列nan存在的个数是否真的很大,如果nan存在的过多,说明这一列对label的影响几乎不起作用了,可以考虑删掉。如果缺失值很小一般可以选择填充;

- 另外可以横向比较,如果在数据集中,某些样本数据的大部分列都是缺失的且样本足够的情况下可以考虑删除;

- Tips: 比赛大杀器lgb模型可以自动处理缺失值;

- 查看训练集测试集中特征属性只有一值的特征;

- 在训练集和测试集中,都只有policyCode这一特征只有一个取值;

one_value_fea = [col for col in data_train.columns if data_train[col].nunique() <= 1]

one_value_fea

# ['policyCode']one_value_fea_test = [col for col in data_test_a.columns if data_test_a[col].nunique() <= 1]

one_value_fea_test

# ['policyCode']print(f'There are {len(one_value_fea)} columns in train dataset with one unique value.')

print(f'There are {len(one_value_fea_test)} columns in test dataset with one unique value.')

# There are 1 columns in train dataset with one unique value.

# There are 1 columns in test dataset with one unique value.总结:47列数据中有22列都缺少数据,这在现实世界中很正常。‘policyCode’具有一个唯一值(或全部缺失)。有很多连续变量和一些分类变量。

查看特征的数值类型有哪些,对象类型有哪些

- 特征一般都是由类别型特征和数值型特征组成,而数值型特征又分为连续型和离散型;

- 类别型特征有时具有非数值关系,有时也具有数值关系。比如‘grade’中的等级A,B,C等,是否只是单纯的分类,还是A优于其他要结合业务判断;

- 数值型特征本是可以直接输入模型的,但往往风控人员要对其做分箱,转化为WOE编码进而做标准评分卡等操作。从模型效果上来看,特征分箱主要是为了降低变量的复杂性,减少变量噪音对模型的影响,提高自变量和因变量的相关度。从而使模型更加稳定;

- 数值型特征有42个,类别型特征有5个;

numerical_fea = list(data_train.select_dtypes(exclude=['object']).columns)

numerical_fea

# ['id',

# 'loanAmnt',

# 'term',

# 'interestRate',

# 'installment',

# 'employmentTitle',

# 'homeOwnership',

# 'annualIncome',

# 'verificationStatus',

# 'isDefault',

# 'purpose',

# 'postCode',

# 'regionCode',

# 'dti',

# 'delinquency_2years',

# 'ficoRangeLow',

# 'ficoRangeHigh',

# 'openAcc',

# 'pubRec',

# 'pubRecBankruptcies',

# 'revolBal',

# 'revolUtil',

# 'totalAcc',

# 'initialListStatus',

# 'applicationType',

# 'title',

# 'policyCode',

# 'n0',

# 'n1',

# 'n2',

# 'n2.1',

# 'n4',

# 'n5',

# 'n6',

# 'n7',

# 'n8',

# 'n9',

# 'n10',

# 'n11',

# 'n12',

# 'n13',

# 'n14']category_fea = list(filter(lambda x: x not in numerical_fea, list(data_train.columns)))

category_fea

# ['grade', 'subGrade', 'employmentLength', 'issueDate', 'earliesCreditLine']data_train.grade

# 0 E

# 1 D

# 2 D

# 3 A

# 4 C

# ..

# 799995 C

# 799996 A

# 799997 C

# 799998 A

# 799999 B

# Name: grade, Length: 800000, dtype: object- 划分数值型变量中的连续型变量和离散型变量;

- 连续型变量有33个,离散型变量有9个;

# 过滤数值型类别特征

def get_numerical_serial_fea(data, feas):

numerical_serial_fea = []

numerical_noserial_fea = []

for fea in feas:

temp = data[fea].nunique()

if temp <= 10:

numerical_noserial_fea.append(fea)

continue

numerical_serial_fea.append(fea)

return numerical_serial_fea, numerical_noserial_fea

numerical_serial_fea, numerical_noserial_fea = get_numerical_serial_fea(data_train, numerical_fea)

numerical_serial_fea

# ['id',

# 'loanAmnt',

# 'interestRate',

# 'installment',

# 'employmentTitle',

# 'annualIncome',

# 'purpose',

# 'postCode',

# 'regionCode',

# 'dti',

# 'delinquency_2years',

# 'ficoRangeLow',

# 'ficoRangeHigh',

# 'openAcc',

# 'pubRec',

# 'pubRecBankruptcies',

# 'revolBal',

# 'revolUtil',

# 'totalAcc',

# 'title',

# 'n0',

# 'n1',

# 'n2',

# 'n2.1',

# 'n4',

# 'n5',

# 'n6',

# 'n7',

# 'n8',

# 'n9',

# 'n10',

# 'n13',

# 'n14']numerical_noserial_fea

# ['term',

# 'homeOwnership',

# 'verificationStatus',

# 'isDefault',

# 'initialListStatus',

# 'applicationType',

# 'policyCode',

# 'n11',

# 'n12']- 离散型变量分析

data_train['term'].value_counts() #离散型变量

# 3 606902

# 5 193098

# Name: term, dtype: int64data_train['homeOwnership'].value_counts() #离散型变量

# 0 395732

# 1 317660

# 2 86309

# 3 185

# 5 81

# 4 33

# Name: homeOwnership, dtype: int64data_train['verificationStatus'].value_counts() #离散型变量

# 1 309810

# 2 248968

# 0 241222

# Name: verificationStatus, dtype: int64data_train['initialListStatus'].value_counts() #离散型变量

# 0 466438

# 1 333562

# Name: initialListStatus, dtype: int64data_train['applicationType'].value_counts() #离散型变量

# 0 784586

# 1 15414

# Name: applicationType, dtype: int64data_train['policyCode'].value_counts() #离散型变量,无用,全部一个值

# 1.0 800000

# Name: policyCode, dtype: int64data_train['n11'].value_counts() #离散型变量,相差悬殊,用不用再分析

# 0.0 729682

# 1.0 540

# 2.0 24

# 4.0 1

# 3.0 1

# Name: n11, dtype: int64data_train['n12'].value_counts() #离散型变量,相差悬殊,用不用再分析

# 0.0 757315

# 1.0 2281

# 2.0 115

# 3.0 16

# 4.0 3

# Name: n12, dtype: int64- 连续型变量分析

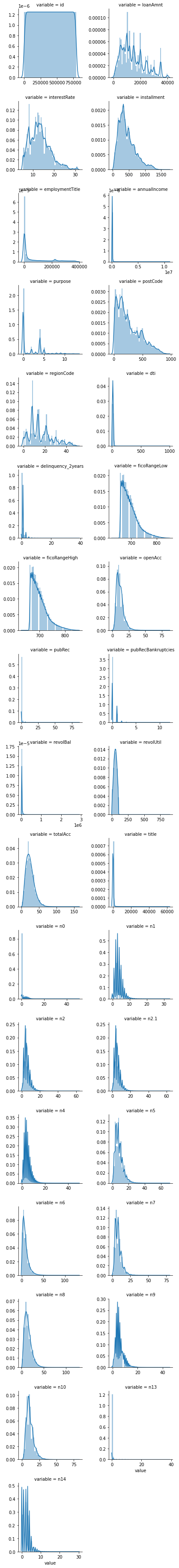

# 每个数字特征的分布可视化

f = pd.melt(data_train, value_vars=numerical_serial_fea)

g = sns.FacetGrid(f, col="variable", col_wrap=2, sharex=False, sharey=False)

g = g.map(sns.distplot, "value")

- 查看某一个数值型变量的分布,查看变量是否符合正态分布,如果不符合正太分布的变量可以log化后再观察下是否符合正态分布。

- 如果想统一处理一批数据变标准化,必须把这些之前已经正态化的数据剔除

- 正态化的原因:一些情况下正态非正态可以让模型更快的收敛,一些模型要求数据正态(eg. GMM、KNN),保证数据不要过偏态即可,过于偏态可能会影响模型预测结果。

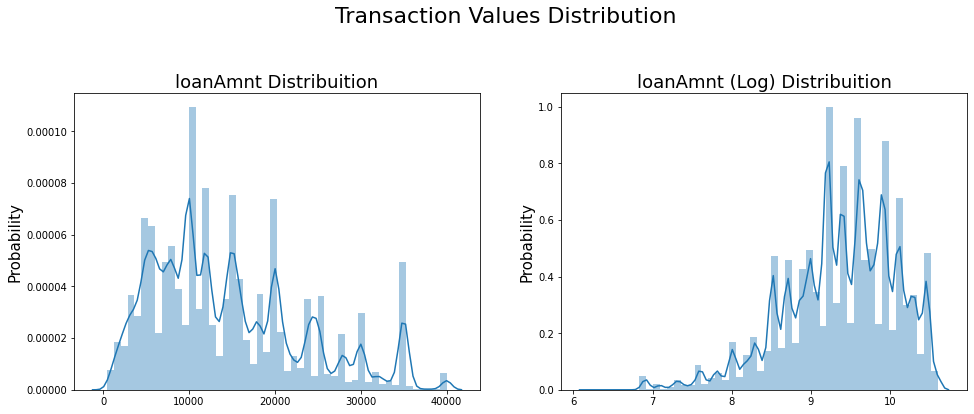

# Ploting Transaction Amount Values Distribution

plt.figure(figsize=(16, 12))

plt.suptitle('Transaction Values Distribution', fontsize=22)

plt.subplot(221)

sub_plot_1 = sns.distplot(data_train['loanAmnt'])

sub_plot_1.set_title("loanAmnt Distribuition", fontsize=18)

sub_plot_1.set_xlabel("")

sub_plot_1.set_ylabel("Probability", fontsize=15)

plt.subplot(222)

sub_plot_2 = sns.distplot(np.log(data_train['loanAmnt']))

sub_plot_2.set_title("loanAmnt (Log) Distribuition", fontsize=18)

sub_plot_2.set_xlabel("")

sub_plot_2.set_ylabel("Probability", fontsize=15)

- 类别型变量分析

data_train['grade'].value_counts()

# B 233690

# C 227118

# A 139661

# D 119453

# E 55661

# F 19053

# G 5364

# Name: grade, dtype: int64data_train['subGrade'].value_counts()

# C1 50763

# B4 49516

# B5 48965

# B3 48600

# C2 47068

# C3 44751

# C4 44272

# B2 44227

# B1 42382

# C5 40264

# A5 38045

# A4 30928

# D1 30538

# D2 26528

# A1 25909

# D3 23410

# A3 22655

# A2 22124

# D4 21139

# D5 17838

# E1 14064

# E2 12746

# E3 10925

# E4 9273

# E5 8653

# F1 5925

# F2 4340

# F3 3577

# F4 2859

# F5 2352

# G1 1759

# G2 1231

# G3 978

# G4 751

# G5 645

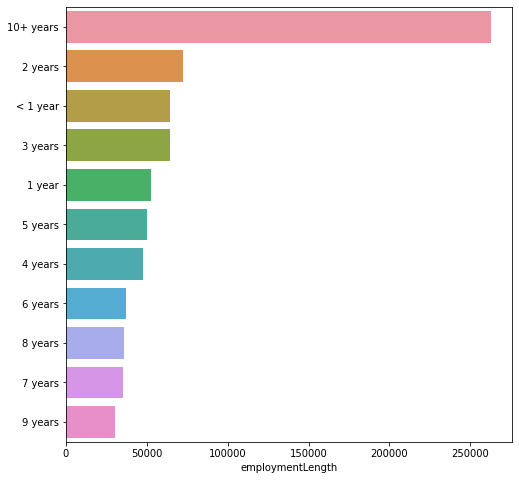

# Name: subGrade, dtype: int64data_train['employmentLength'].value_counts()

# 10+ years 262753

# 2 years 72358

# < 1 year 64237

# 3 years 64152

# 1 year 52489

# 5 years 50102

# 4 years 47985

# 6 years 37254

# 8 years 36192

# 7 years 35407

# 9 years 30272

# Name: employmentLength, dtype: int64data_train['issueDate'].value_counts()

# 2016-03-01 29066

# 2015-10-01 25525

# 2015-07-01 24496

# 2015-12-01 23245

# 2014-10-01 21461

# ...

# 2007-08-01 23

# 2007-07-01 21

# 2008-09-01 19

# 2007-09-01 7

# 2007-06-01 1

# Name: issueDate, Length: 139, dtype: int64data_train['earliesCreditLine'].value_counts()

# Aug-2001 5567

# Aug-2002 5403

# Sep-2003 5403

# Oct-2001 5258

# Aug-2000 5246

# ...

# Mar-1958 1

# Nov-1953 1

# Feb-1960 1

# Jul-1955 1

# Dec-1960 1

# Name: earliesCreditLine, Length: 720, dtype: int64data_train['isDefault'].value_counts()

# 0 640390

# 1 159610

# Name: isDefault, dtype: int64总结:

- 上面我们用value_counts()等函数看了特征属性的分布,但是图表是概括原始信息最便捷的方式;

- 数无形时少直觉;

- 同一份数据集,在不同的尺度刻画上显示出来的图形反映的规律是不一样的。python将数据转化成图表,但结论是否正确需要由你保证;

变量分布可视化

-

单一变量分布可视化;

plt.figure(figsize=(8, 8))

sns.barplot(

data_train["employmentLength"].value_counts(dropna=False)[:20],

data_train["employmentLength"].value_counts(dropna=False).keys()[:20]

)

plt.show()

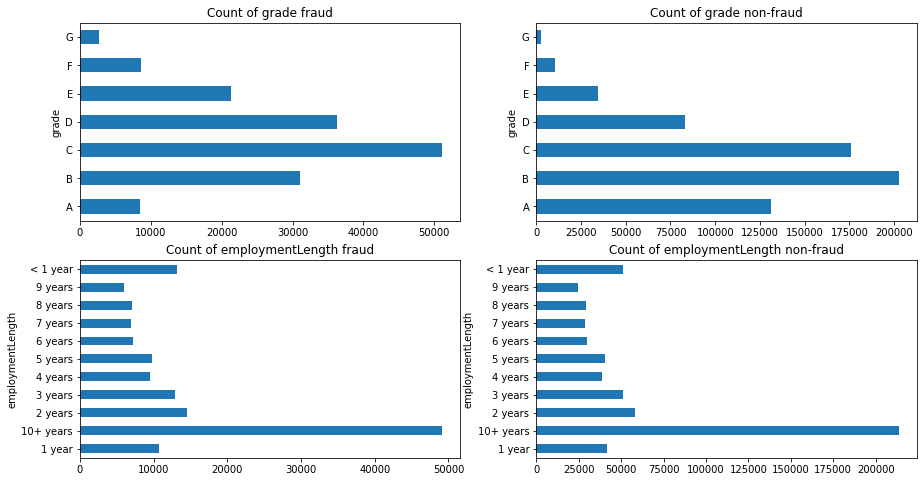

- 首先查看类别型变量在不同y值上的分布;

train_loan_fr = data_train.loc[data_train['isDefault'] == 1]

train_loan_nofr = data_train.loc[data_train['isDefault'] == 0]

fig, ((ax1, ax2), (ax3, ax4)) = plt.subplots(2, 2, figsize=(15, 8))

train_loan_fr.groupby('grade')['grade'].count().plot(kind='barh', ax=ax1, title='Count of grade fraud')

train_loan_nofr.groupby('grade')['grade'].count().plot(kind='barh', ax=ax2, title='Count of grade non-fraud')

train_loan_fr.groupby('employmentLength')['employmentLength'].count().plot(kind='barh', ax=ax3, title='Count of employmentLength fraud')

train_loan_nofr.groupby('employmentLength')['employmentLength'].count().plot(kind='barh', ax=ax4, title='Count of employmentLength non-fraud')

plt.show()

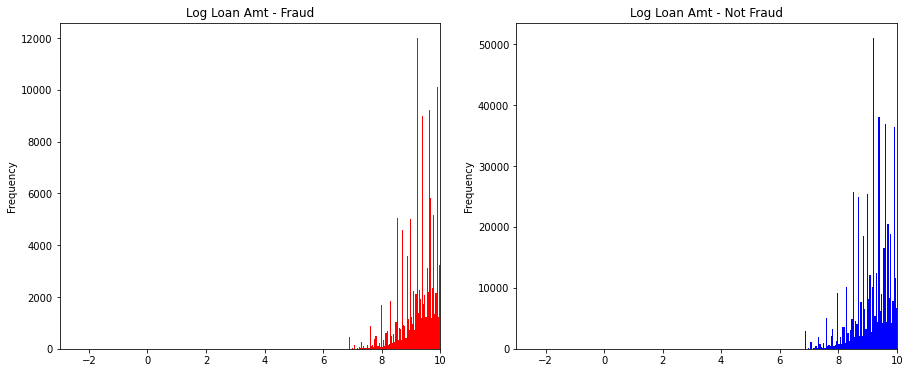

- 其次查看连续型变量在不同y值上的分布;

fig, ((ax1, ax2)) = plt.subplots(1, 2, figsize=(15, 6))

data_train.loc[data_train['isDefault'] == 1]['loanAmnt'].apply(np.log).plot(

kind='hist', bins=100, title='Log Loan Amt - Fraud', color='r', xlim=(-3, 10), ax= ax1)

data_train.loc[data_train['isDefault'] == 0]['loanAmnt'].apply(np.log).plot(

kind='hist', bins=100, title='Log Loan Amt - Not Fraud', color='b', xlim=(-3, 10), ax=ax2)

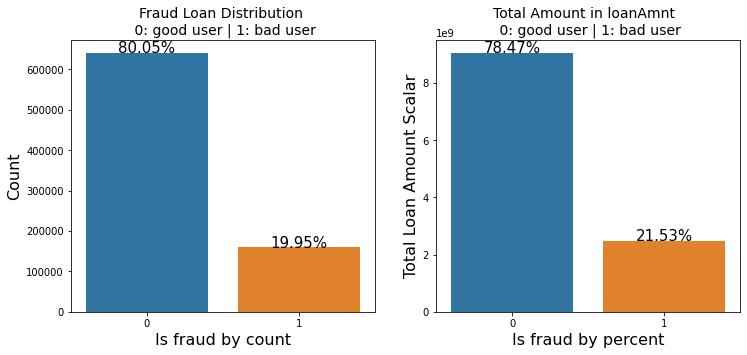

total = len(data_train)

total_amt = data_train.groupby(['isDefault'])['loanAmnt'].sum().sum()

plt.figure(figsize=(12, 5))

plt.subplot(121) ##1代表行,2代表列,所以一共有2个图,1代表此时绘制第一个图。

plot_tr = sns.countplot(x='isDefault',data=data_train) #data_train‘isDefault’这个特征每种类别的数量**

plot_tr.set_title("Fraud Loan Distribution n 0: good user | 1: bad user", fontsize=14)

plot_tr.set_xlabel("Is fraud by count", fontsize=16)

plot_tr.set_ylabel('Count', fontsize=16)

for p in plot_tr.patches:

height = p.get_height()

plot_tr.text(p.get_x()+p.get_width()/2., height+3, '{:1.2f}%'.format(height/total*100), ha="center", fontsize=15)

percent_amt = data_train.groupby(['isDefault'])['loanAmnt'].sum()

percent_amt = percent_amt.reset_index()

plt.subplot(122)

plot_tr_2 = sns.barplot(x='isDefault', y='loanAmnt', dodge=True, data=percent_amt)

plot_tr_2.set_title("Total Amount in loanAmnt n 0: good user | 1: bad user", fontsize=14)

plot_tr_2.set_xlabel("Is fraud by percent", fontsize=16)

plot_tr_2.set_ylabel('Total Loan Amount Scalar', fontsize=16)

for p in plot_tr_2.patches:

height = p.get_height()

plot_tr_2.text(p.get_x()+p.get_width()/2., height+3, '{:1.2f}%'.format(height/total_amt * 100), ha="center", fontsize=15)

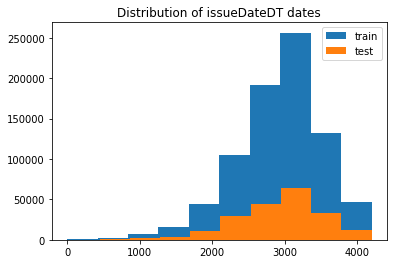

时间格式数据处理及查看

# 转化成时间格式:issueDateDT特征表示数据日期离数据集中日期最早的日期(2007-06-01)的天数

data_train['issueDate'] = pd.to_datetime(data_train['issueDate'], format='%Y-%m-%d')

startdate = datetime.datetime.strptime('2007-06-01', '%Y-%m-%d')

data_train['issueDateDT'] = data_train['issueDate'].apply(lambda x: x-startdate).dt.days

# 转化成时间格式

data_test_a['issueDate'] = pd.to_datetime(data_test_a['issueDate'], format='%Y-%m-%d')

startdate = datetime.datetime.strptime('2007-06-01', '%Y-%m-%d')

data_test_a['issueDateDT'] = data_test_a['issueDate'].apply(lambda x: x-startdate).dt.days

#train 和 test issueDateDT 日期有重叠 所以使用基于时间的分割进行验证是不明智的

plt.hist(data_train['issueDateDT'], label='train');

plt.hist(data_test_a['issueDateDT'], label='test');

plt.legend();

plt.title('Distribution of issueDateDT dates');

掌握透视图可以让我们更好的了解数据

#透视图:索引可以有多个,“columns(列)”是可选的,聚合函数aggfunc最后是被应用到了变量“values”中你所列举的项目上。

pivot = pd.pivot_table(data_train, index=['grade'], columns=['issueDateDT'], values=['loanAmnt'], aggfunc=np.sum)

pivot| loanAmnt | |||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| issueDateDT | 0 | 30 | 61 | 92 | 122 | 153 | 183 | 214 | 245 | 274 | ... | 3926 | 3957 | 3987 | 4018 | 4048 | 4079 | 4110 | 4140 | 4171 | 4201 |

| grade | |||||||||||||||||||||

| A | NaN | 53650.0 | 42000.0 | 19500.0 | 34425.0 | 63950.0 | 43500.0 | 168825.0 | 85600.0 | 101825.0 | ... | 13093850.0 | 11757325.0 | 11945975.0 | 9144000.0 | 7977650.0 | 6888900.0 | 5109800.0 | 3919275.0 | 2694025.0 | 2245625.0 |

| B | NaN | 13000.0 | 24000.0 | 32125.0 | 7025.0 | 95750.0 | 164300.0 | 303175.0 | 434425.0 | 538450.0 | ... | 16863100.0 | 17275175.0 | 16217500.0 | 11431350.0 | 8967750.0 | 7572725.0 | 4884600.0 | 4329400.0 | 3922575.0 | 3257100.0 |

| C | NaN | 68750.0 | 8175.0 | 10000.0 | 61800.0 | 52550.0 | 175375.0 | 151100.0 | 243725.0 | 393150.0 | ... | 17502375.0 | 17471500.0 | 16111225.0 | 11973675.0 | 10184450.0 | 7765000.0 | 5354450.0 | 4552600.0 | 2870050.0 | 2246250.0 |

| D | NaN | NaN | 5500.0 | 2850.0 | 28625.0 | NaN | 167975.0 | 171325.0 | 192900.0 | 269325.0 | ... | 11403075.0 | 10964150.0 | 10747675.0 | 7082050.0 | 7189625.0 | 5195700.0 | 3455175.0 | 3038500.0 | 2452375.0 | 1771750.0 |

| E | 7500.0 | NaN | 10000.0 | NaN | 17975.0 | 1500.0 | 94375.0 | 116450.0 | 42000.0 | 139775.0 | ... | 3983050.0 | 3410125.0 | 3107150.0 | 2341825.0 | 2225675.0 | 1643675.0 | 1091025.0 | 1131625.0 | 883950.0 | 802425.0 |

| F | NaN | NaN | 31250.0 | 2125.0 | NaN | NaN | NaN | 49000.0 | 27000.0 | 43000.0 | ... | 1074175.0 | 868925.0 | 761675.0 | 685325.0 | 665750.0 | 685200.0 | 316700.0 | 315075.0 | 72300.0 | NaN |

| G | NaN | NaN | NaN | NaN | NaN | NaN | NaN | 24625.0 | NaN | NaN | ... | 56100.0 | 243275.0 | 224825.0 | 64050.0 | 198575.0 | 245825.0 | 53125.0 | 23750.0 | 25100.0 | 1000.0 |

7 rows × 139 columns

用pandas_profiling生成数据报告

import pandas_profiling

pfr = pandas_profiling.ProfileReport(data_train)

pfr.to_file("./example.html")总结

数据探索性分析是我们初步了解数据,熟悉数据为特征工程做准备的阶段,甚至很多时候EDA阶段提取出来的特征可以直接当作规则来用。可见EDA的重要性,这个阶段的主要工作还是借助于各个简单的统计量来对数据整体的了解,分析各个类型变量相互之间的关系,以及用合适的图形可视化出来直观观察。

最后

以上就是忧郁冥王星最近收集整理的关于【金融风控-贷款违约预测】数据挖掘学习:2.数据分析目录学习目标内容介绍代码示例总结的全部内容,更多相关【金融风控-贷款违约预测】数据挖掘学习:2内容请搜索靠谱客的其他文章。

本图文内容来源于网友提供,作为学习参考使用,或来自网络收集整理,版权属于原作者所有。

![[2022-kaggle]-Novozymes Enzyme Stability Prediction前排高分baseline(Novozymes 酶稳定性预测)](https://www.shuijiaxian.com/files_image/reation/bcimg14.png)

发表评论 取消回复